pay indiana state sales taxes

Any employees will also need to pay state income tax. Take the renters deduction.

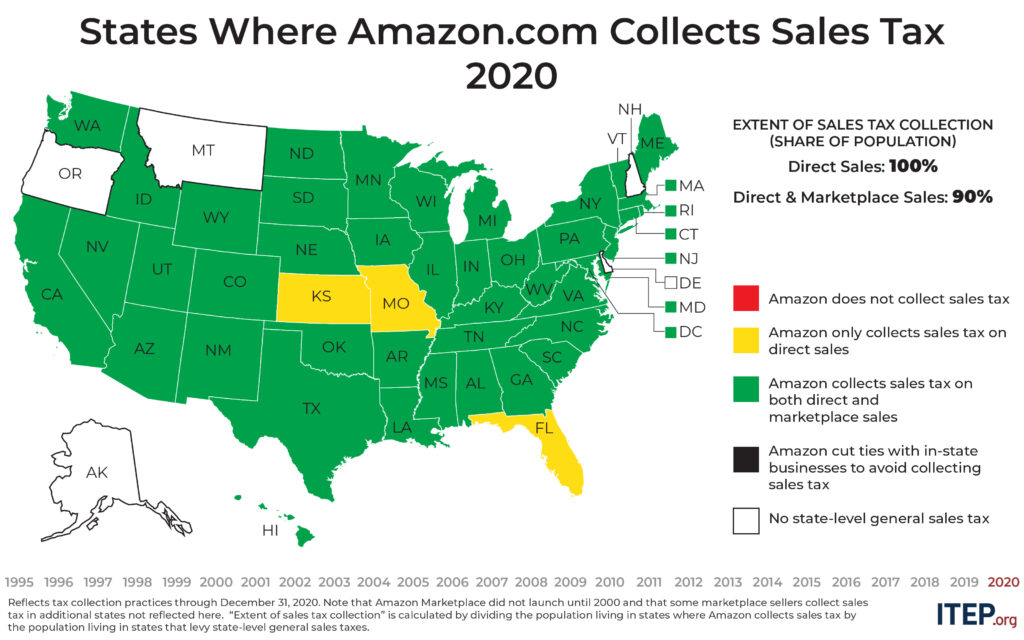

A Visual History Of Sales Tax Collection At Amazon Com Itep

You can find your amount due and pay online using the intimedoringov electronic payment system.

. The collection discount is 073 of the total annual sales tax collected and if the complete. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state. Pay my tax bill in installments.

INtax is a product of the Indiana Department of Revenue. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. Ad New State Sales Tax Registration.

Have more time to file my taxes and I think I will owe the Department. Indiana county resident and nonresident income tax rates are available via Department Notice 1. Note that Indiana law IC 6-25-2-1c requires a seller without a physical location in Indiana to obtain a registered retail merchants certificate collect and remit applicable sales tax if the seller meets either or both of the following conditions in the.

In addition to taxes car purchases in Indiana may be subject to other fees like registration title and plate fees. Pay my tax bill in installments. For the feds youll need to register with the IRS.

The Indiana income tax rate is set to 323 percent. Start filing your tax return now. Claim a gambling loss on my Indiana return.

Completing Form ES-40 and mailing it with your payment. Indiana collects a 7 state sales tax rate on the purchase of all vehicles. You will need to select the filing period end date and click Next.

DORs new e-service portal at intimedoringov. Then select File Form ST-103. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales.

Claim a gambling loss on my Indiana return. Download Or Email Form ST-105 More Fillable Forms Register and Subscribe Now. 4031 S East Street Indianapolis IN 46227.

You are supposed to pay the 7 sales tax less any foreign sales tax paid. Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal. Indiana car sales tax questions answered.

Take the renters deduction. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Have more time to file my taxes and I think I will owe the Department.

100s of Top Rated Local Professionals Waiting to Help You Today. Your browser appears to have cookies disabled. Sales Tax Collection Discounts In Indiana.

Here are your payment options. Claim a gambling loss on my Indiana return. For Indiana you actually have to navigate to the left side of the screen and find the File tab.

Key in Sales Data. But the water gets a little murky if your service results intangible personal property. However some counties within Indiana have an additional tax rate making the combined.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. County Rates Available Online. If you are in a state where the trade-in is considered a down payment the sales tax is calculated by multiplying the rate by the purchased car price.

Pay my tax bill in installments. Have more time to file my taxes and I think I will owe the Department. The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax.

Know when I will receive my tax refund. Indiana State Sales Tax information registration support. You are not obligated to pay sales tax in Indiana if you offer a service.

Find out what the Indiana sales tax and fees on used cars are. Cookies are required to use this site. Find Indiana tax forms.

INTIME now offers the ability to manage all tax accounts in one convenient location 247. But for the Department of Revenue you can do it here. If you work in or have business income from Indiana you will likely need to file a tax return with us.

If the tax rate of your state is less than 7 you have to pay the. Indiana allows merchants to keep a small percentage of the sales tax they collect as a collection discount which serves as compensation for the work required to comply with the Indiana sales tax regulations. If you have filed returns for other states you will appreciate.

Take the renters deduction. Complete Edit or Print Tax Forms Instantly. Corporations must pay the Indiana Corporate Income Tax but LLC businesses avoid double taxation.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. All businesses in Indiana must file and pay their sales and withholding taxes electronically. Find Indiana tax forms.

Ad Access Tax Forms. Learn about the required federal state and sales taxes you might need to pay. Indiana businesses have to pay taxes at the state and federal levels.

Find Indiana tax forms. DOR offers customers several payment options including payment plans for liabilities over 100. SalesTaxHandbook visitors qualify for a.

Know when I will receive my tax refund. This registration can be completed in INBiz. You do not need to create an INTIME logon to.

If you buy a car in another state and pay sales tax there you receive a credit for the amount you paid. Know when I will receive my tax refund. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding corporate income tax and individual income tax in one convenient location 247.

After your business is registered in Indiana you will begin paying state and local income taxes on any profits earned in Indiana and sales tax on any tangible property sold or shipped from the state. You will be directed to this page. An INTIME Functionality chart listed by tax type is available.

This includes filing returns making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer. Exemptions to the Indiana sales tax will vary by state.

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States Without Sales Tax Article

Get Ready To Pay Sales Tax On Amazon

How To Collect And Pay Sales Tax In Quickbooks Desktop Youtube

How Do State And Local Sales Taxes Work Tax Policy Center

Indiana Sales Tax Small Business Guide Truic

How High Are Sales Taxes In Your State Tax Foundation

.png)

States Sales Taxes On Software Tax Foundation

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax Return

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Updated State And Local Option Sales Tax Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

A Visual History Of Sales Tax Collection At Amazon Com Itep

What Canadian Businesses Need To Know About U S Sales Tax

Recently Amazon Com Announced That It Would Begin Collecting Sales Tax For Sales In Some States Today From The Vault Money Smart Week Smart Money State Tax